DUTY REDUCTION

One way companies realize cost savings through a Foreign Trade Zone operation is through Duty Reduction.

In an FTZ, with the permission of the Foreign Trade Zones Board, users are allowed to elect a zone status on merchandise admitted to the zone. This zone status determines the duty rate that will be applied to foreign merchandise if it is eventually entered into U.S. commerce from the FTZ. This process allows users to elect the lower duty rate applied to either the foreign inputs or the finished product manufactured in the zone. If the rate on the foreign inputs admitted to the zone is higher than the rate applied to the finished product, the FTZ user may choose the finished product rate, thereby reducing the amount of duty owed.

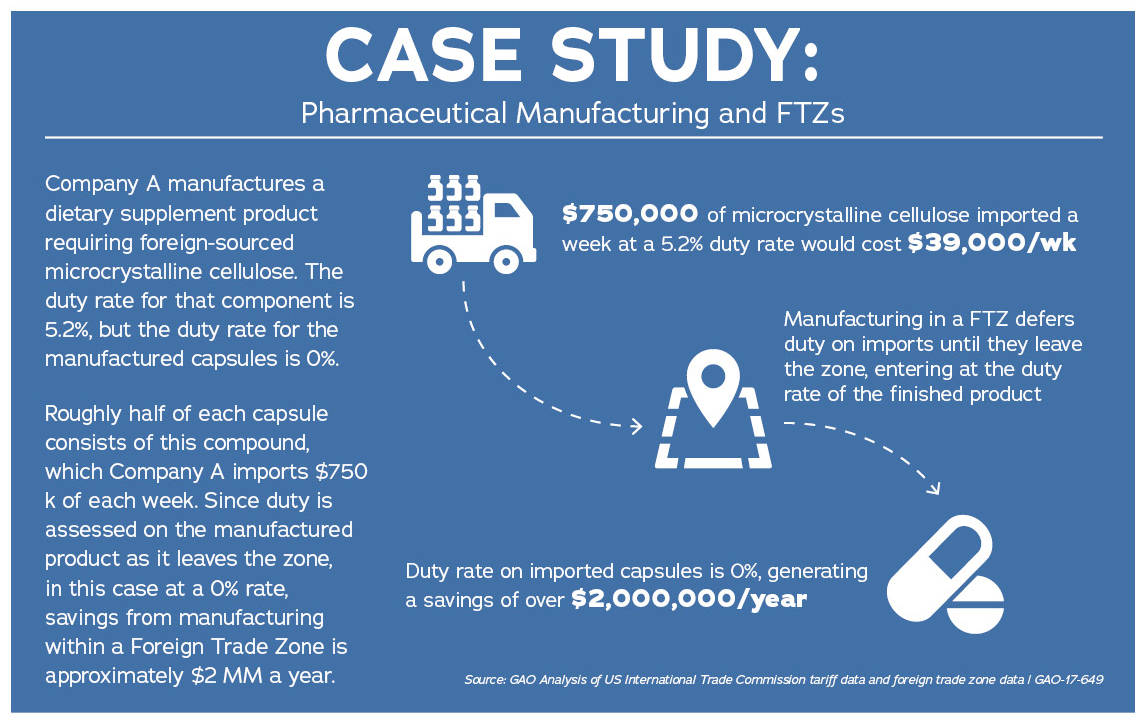

Company A manufactures a dietary supplement product requiring foreign-sourced microcrystalline cellulose. The duty rate for that component is 5.2%, but the duty rate for the manufactured capsules is 0%.

Roughly half of each capsule consists of this compound, which Company A imports $750 k of each week. Since duty is assessed on the manufactured product as it leaves the zone, in this case at a 0% rate, savings from manufacturing within a Foreign Trade Zone is approximately $2 MM a year.

See More Ways To Save with a Foreign Trade Zone