In today’s dynamic global marketplace, companies are constantly seeking strategies to enhance competitiveness and optimize operations.

Foreign Trade Zones (FTZs) emerge as a powerful tool in this pursuit, offering a unique set of advantages that can significantly reduce expenses and fuel business growth.

What are FTZs and how do they work?

Established by the Foreign Trade Zones Act of 1934, FTZs are designated areas within the United States, typically located near ports of entry. They operate under special customs procedures, essentially functioning as duty-free zones for businesses. This means that, under CBP (Customs and Border Protection) supervision, imported goods can be stored, manipulated, assembled, or manufactured within the FTZ without incurring immediate customs duties.

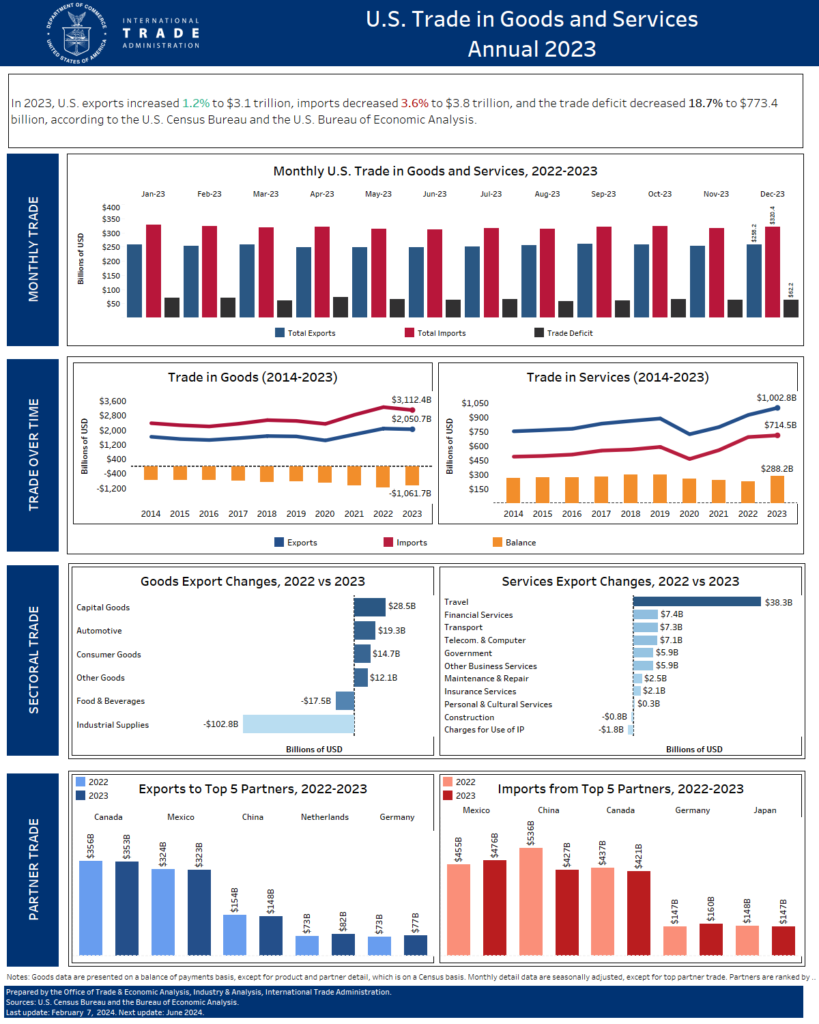

Did you know that in 2023. US exports increased 1.2% to 3.1 trillion. Check below the latest data from the US International Trade Administration.

The compelling benefits of FTZs

FTZs offer a multitude of advantages that can transform your business operations:

Reduced costs

The cornerstone of the FTZ program is its ability to minimize customs duties. Companies can:

- Eliminate duties entirely on goods that are re-exported.

- Defer duty payments on goods entering the domestic market, significantly improving cash flow.

- Potentially reduce duties through duty drawback programs on finished products containing imported materials.

Enhanced competitiveness

By lowering operational costs, FTZs level the playing field for U.S. businesses competing with foreign manufacturers. This allows companies to offer more competitive pricing and capture a larger market share.

Job creation and economic development

FTZs act as catalysts for economic growth by attracting businesses and fostering domestic production. This leads to increased job creation within the zone and surrounding communities.

Supply chain optimization

FTZs streamline supply chain management by allowing for duty-paid and duty-deferred inventory within the zone. This flexibility facilitates efficient just-in-time manufacturing processes and reduces overall logistics costs.

Investment magnet

The combination of reduced costs, streamlined procedures, and a business-friendly environment makes FTZs highly attractive to foreign and domestic investors. This fosters increased capital inflow and economic activity within the zone.

If you love crunching numbers, you’ll be impressed by the bottom-line benefits of FTZs.